بِسْمِ ٱللّٰهِ ٱلرَّحْمٰنِ ٱلرَّحِيمِ

لَا إِلَٰهَ إِلَّا ٱللَّٰهُ مُحَمَّدٌ رَسُولُ ٱللَّٰهِ

PeopleQlik #1 Payroll Software in Saudi Arabia For most business visionaries, doing payroll is one of the most confounding, dull and tedious business works out—yet on the other hand it’s one of the most fundamental ones! Issues can bring down operator resolve, tie up essential affiliation assets and wreck even the best business.

PeopleQlik #1 Payroll Software in Saudi Arabia

Register for an Employer Identification Number

Before you can begin putting workers on Payroll Software in Saudi Arabia , you will require an Employer Identification Number (EIN). Much identical to your Social Security number (SSN) is to you as an individual, your EIN is an approach to manage and see your independent undertaking for charge purposes.

Most, at any rate not all, business individuals need to get an EIN before they can apply for licenses, file Payroll Software in Saudi Arabia stacks or even open a financial balance. Contingent upon where your business is based, you may need to get a state-level EIN on head of your administration EIN.

Pick Pay Schedule and Salary Status

Pay rehash and pay status are two of the key choices you need to make as a business individual. We ought to disconnect that:

Pay rehash, for any situation called pay plan, is the point at which you pay your workers and how routinely they get paid. Check government and state laws to guarantee that you are meeting your area’s base payday laws. The most extensively saw Payroll Software in Saudi Arabia plans incorporated after a long time after week, each other week and routinely reserved installments. Regardless of what you pick, keep it unsurprising and pay on schedule.

Pay status is the strategy by which wages are figured. You can pick between paying an hourly rate (nonexempt workers) or paying a remuneration (absolved operators). The correct compensation status is all around set up on the individual needs of your independent undertaking comparatively as the pro’s position.

Acknowledge and Abide by Wage Laws

For any situation, your business or affiliation must be lovely with both government and state laws. This recommends you (or somebody in your affiliation) needs to comprehend what your genuine and budgetary obligations are as a business.

Assurance that you’re paying the correct business charges/Federal Insurance Contributions Act (FICA) charges (i.e., Social Security and Medicare), the correct neighborhood and state charge, and the correct yearly assessment per worker. Twofold check your payroll procedure to guarantee that each representative gets paid totally and on time. Screen your Payroll Software in Saudi Arabia charge stores to guarantee they keep to an ordinary timetable as indicated by your cost responsibility.

Configuration Your Payroll Policy and Processes

Preceding running your first Payroll Software in Saudi Arabia, it’s fundamental to build up a standard payroll method. This guarantees everybody from the heads to HR to your representatives is in a comparative spot about how payroll limits, when the payroll time span is, the entirety they can plan to bring home, and how benefits (leave, extra time, and so forth) are paid.

Utilize a Time-Tracking System

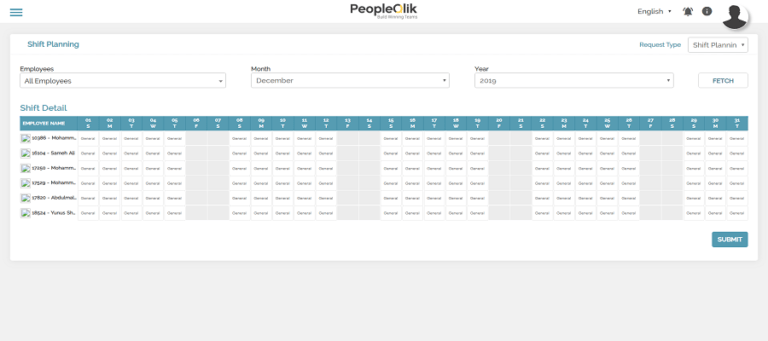

A timekeeping framework is an extraordinary methodology to deal with your workers’ efficiency and ascertain their wages, particularly if you’re paying hourly rates. It’s fundamental to have a period overall positioning structure that is both simple to utilize yet hard to control. There are a wide extent of time sheet blueprints, including frameworks that incorporate really into your Payroll Software in Saudi Arabia for generously more definite information paying little heed to what you resemble at it.

Screen Your Cash Flow

It is each business individual’s biggest dread: not having enough money to pay your specialists. In case you’re routinely short during payroll period, investigating your income could assist you with distinguishing the base of the issue.

It is each business individual’s biggest dread: not having enough money to pay your workers. In case you’re dependably short during Payroll System in Saudi Arabia period, investigating your income could assist you with distinguishing the base of the issue. Checking your income will assist you with spotting potential payroll issues like overstaffing or overpaying. During financially upsetting periods, attempt to postpone a transporter installment or gather uncommon client installments before falling back on more extraordinary income the heads techniques like deferring wages or scaling back.

Put resources into a Payroll Manager/Point Person

Payroll can be a bewildered undertaking, particularly concerning medium-to huge assessed business, so it’s nothing unanticipated that different affiliations choose the most un-troublesome yet most solid other choice: employing an expert Payroll Software in Saudi Arabia boss.

Instead of investing hours of your own essentialness taking thought of payroll, why not put resources into somebody who can improve and speedier with the target that you can invest additional time really maintaining your business? On the off chance that for the duration of the day payroll staff won’t fit in your spending plan, consider recruiting a counsel or essentially assigning the errand to one of your generally gifted and confided in operators.

Keep up Employee and Payroll Records

Both administrative and state governments have laws about holding and putting perpetually payroll records, if administration working environments need to get to that information. For dynamic operators, you can’t discard time cards for a long time, and any payroll information concerning paid wages for at any rate is three years. There are additional laws administering the clearing of payroll records after the end.

Click to Start Whatsapp Chatbot with Sales

Mobile: +966547315697

Email: sales@bilytica.com

Payroll Solutions in Saudi Arabia

Payroll System in Saudi Arabia

What is HR Payroll Solutions in Saudi Arabia?

Payroll Solutions in Saudi Arabia

Payroll System in Saudi Arabia

Attendance Payroll Software in Saudi Arabia